Lhdn 2017 Tax Relief

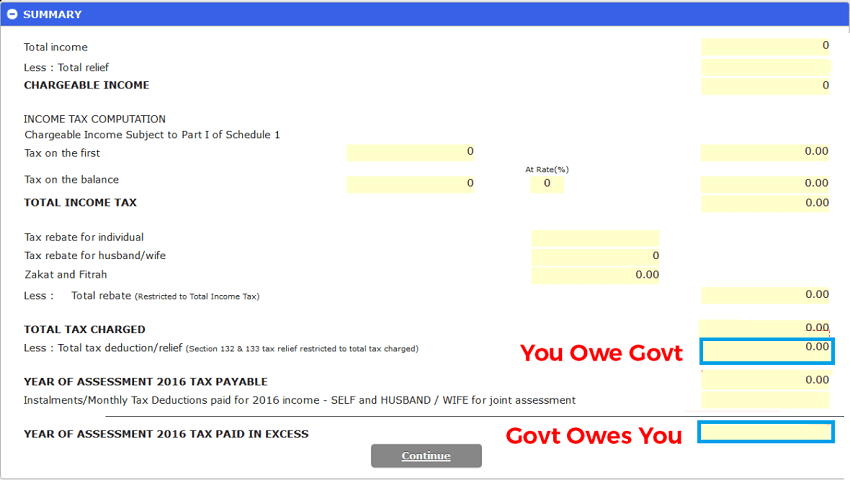

The amount of tax relief 2017 is determined according to government s graduated scale.

Lhdn 2017 tax relief. The example as at below. Ben is earning a rm 40 000 per year salary. According to the income tax act 1967 section 46 1 q a breastfeeding equipment refers to a breast pump kit and an ice pack a breast milk collection and storage. Tax administration diagnostic assessment tool tadat.

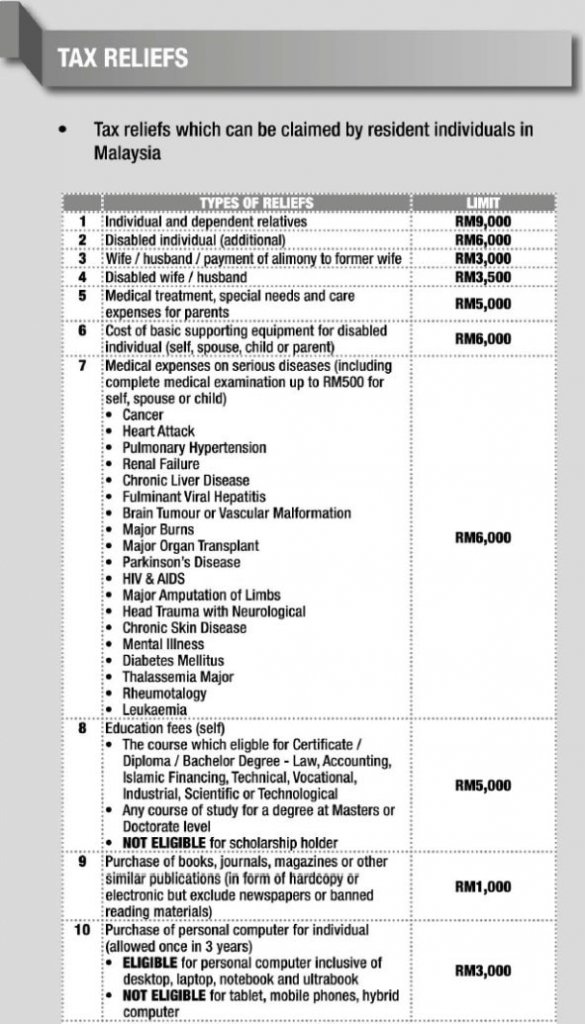

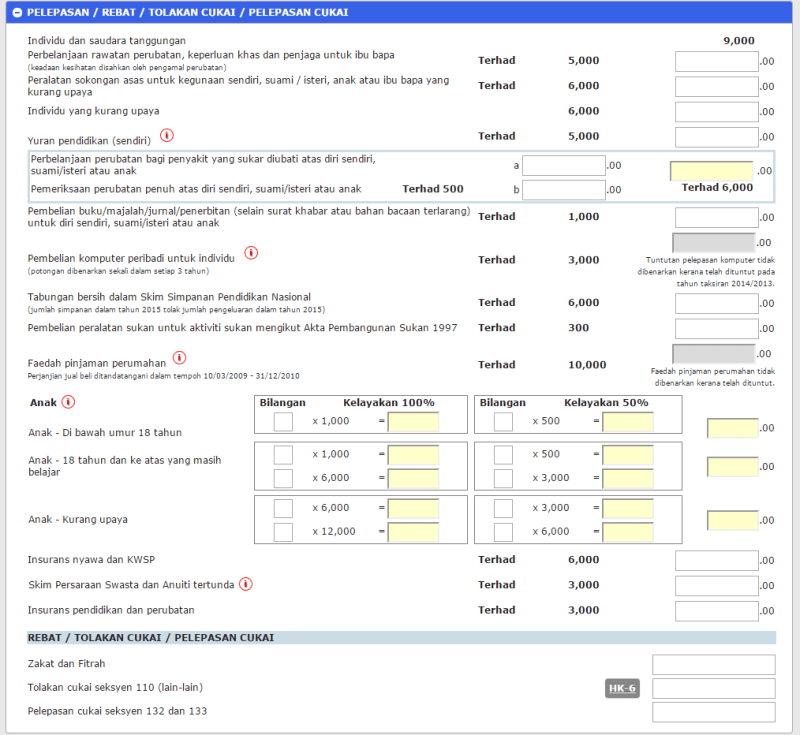

The government has added a lifestyle tax relief during the 2017 budget which now includes smartphones tablets and monthly internet subscription bills. The government via lhdn filed the suit on july 24 last year after accusing tengku adnan of tax evasion for assessment years 2012 to 2017 as stated in the assessment notice dated march 15 last year. E filing 2017 tax relief in a few months it is that time again where we need to fill up the e filing thing required by lembaga hasil dalam negeri lhdn. Tax reliefs are set by lhdn where a taxpayer is able to deduct a certain amount for money expended in that assessment year from the total annual income.

Medical expenses for parents. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. 5 000 limited 3. The gobear complete guide to lhdn income tax reliefs.

Effective for year of assessment 2017 tax filed in 2018 the lifestyle tax relief at a limit of rm2 500 yearly also includes new categories such as the purchase of printed newspapers smartphones and tablets internet subscriptions as well as gymnasium membership fees. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Amount rm 1. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually.

Medical expenses for parents. Malaysian government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the. Jumlah simpanan dalam tahun 2017 tolak jumlah pengeluaran dalam tahun 2017 6 000 terhad. This relief is applicable for year assessment 2013 only.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. According to lembaga hasil dalam negeri lhdn with effect from year 2016 an individual who earns an annual employment income of rm 25 501 after deduction of epf has to register a tax file. This relief is applicable for year assessment 2013 and 2015 only.