How To Calculate Dividends With Revenue And Expenses

Keep in mind that this is only a tool for the investor to utilize.

How to calculate dividends with revenue and expenses. Assuming all other factors are equivalent an investor looking to use their portfolio to supplement their income would likely prefer abc s stock over that of xyz as it has double the dividend yield. Dividends are money paid to investors as a return on their investments. While this includes stocks that don t pay dividends calculating dividends this way gives you a percentage that tells you how well the dividend income of a given stock. Some dividends you receive are in certain paisa per share others pay numerous rupees per share.

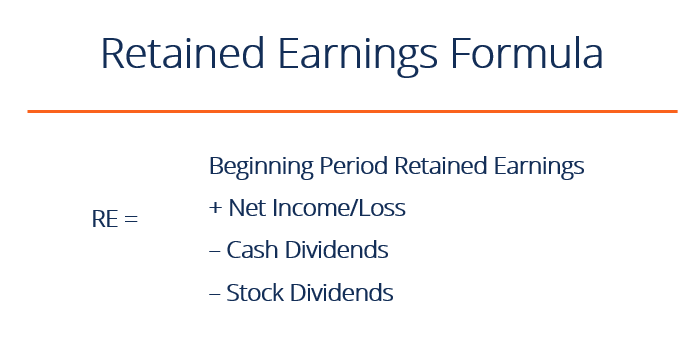

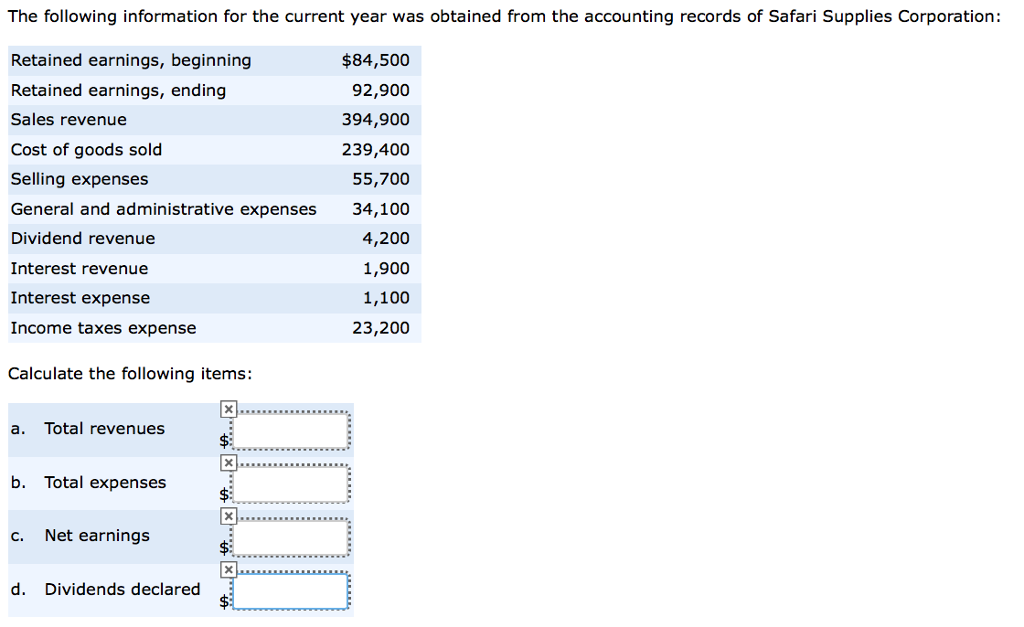

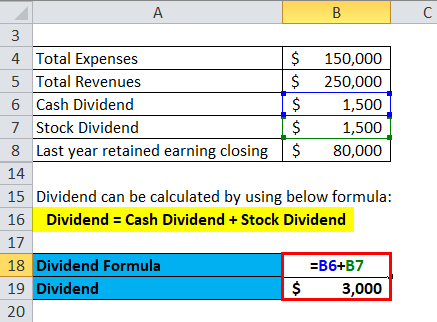

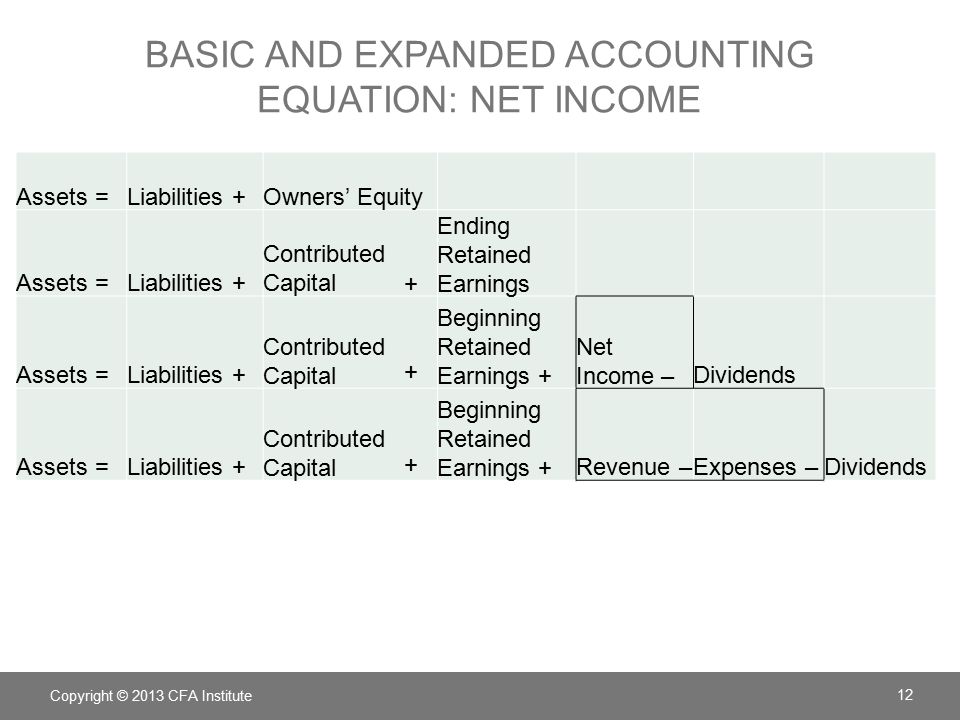

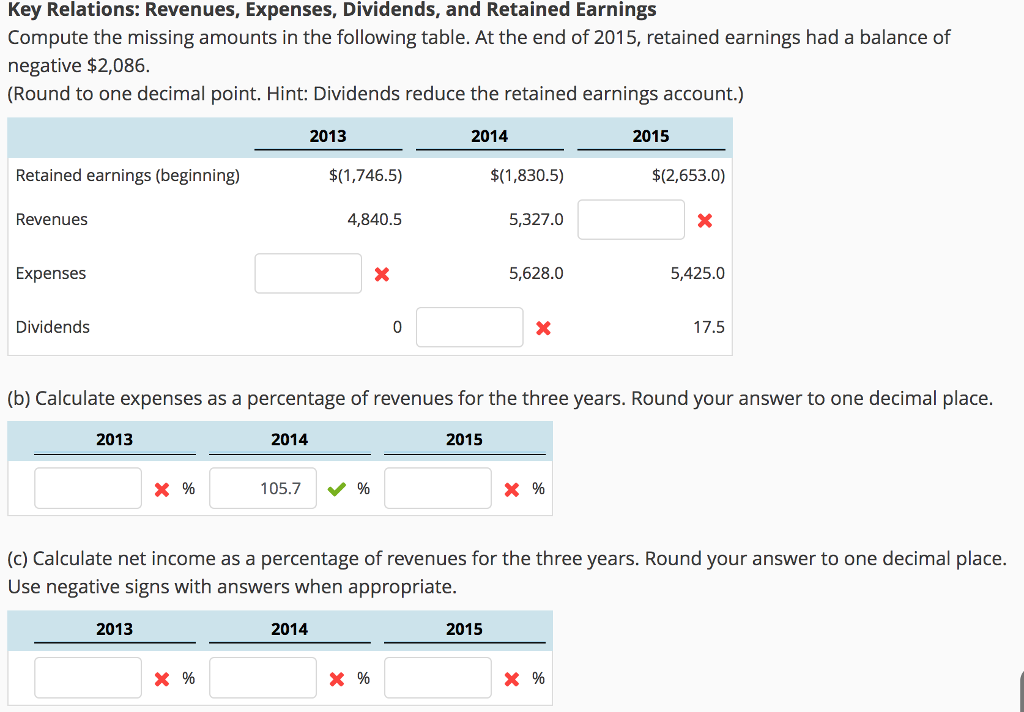

Another way to calculate the dividend payout ratio is on a per share basis in this case the formula used is dividends per share divided by earnings per share eps. Assets liabilities revenue expenses. One way to calculate total dividends paid in any given period is to look at net income and the change in retained earnings. Investors often use dividend yields to determine whether to make certain investments or not.

Eps represents net income. Dividends are usually paid quarterly in some cases semi yearly or annually in installments made by the company to their shareholders as a method for sharing net profits. Divide the company s dividends by its number of shares outstanding to calculate the dividends per share which is the amount of dividends it pays for each share of stock. Company abc s dividend yield is 5 1 20 while xyz s dividend yield is only 2 5 1 40.

To calculate how much you ll pay in taxes multiply the tax rate that applies to the dividends by your dividend income. Multiply the company s payout ratio by its net income to calculate its dividends. Dividend income guide and how to calculate dividends. In the example multiply 40 percent or 0 4 by 120 000 to get 48 000 in dividends.

In its written form the extended accounting equation looks like this. It is not meant to be taken as a stand alone investment guide. You can calculate dividend growth for individual stocks you own or you can calculate a stock s dividend yield as a percentage of the value of your entire portfolio. Use dividend yields to compare investment opportunities.

For instance an investor who s looking for a steady regular source of income might invest in a company with a high dividend yield. Net income profits or losses earned a period of time.

:max_bytes(150000):strip_icc()/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

/EAE-e75afd7778c6484da673c69f0fdfbb55.png)