Gst Submission Malaysia Guide

Apa apa permohonan rayuan cbp.

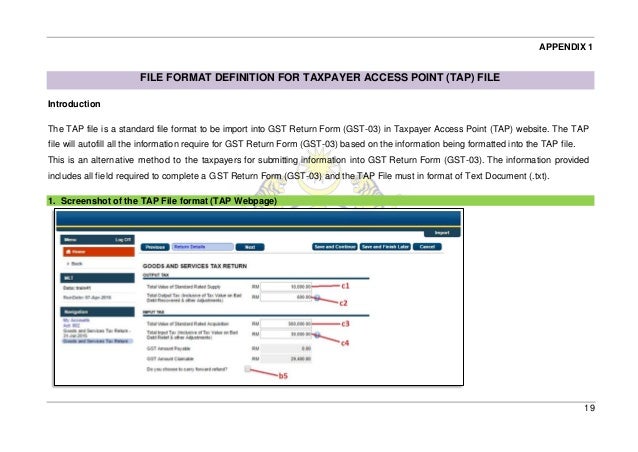

Gst submission malaysia guide. 1 2 you should read this guide if you are a gst registered person and require assistance on the completion of your gst return. Submission gst 03 return for final taxable period. Crowe malaysia plt is the 5th largest accounting firm in malaysia and. On the implementation of gst sales tax act 1972 and the service tax act 1975 was repealed.

This will guide you on how to make the return and payment through online at official website of malaysia sales service tax sst. The one hundred and twenty 120 days period allocated by the. Other related guides 2. This booklet is a general guide on goods and services tax gst.

Item for inclusion in final gst return. The manual guide covered topics of below. Following the rationalization and fiscal reforms program being implemented by the government the two repealed acts and its respective. All input tax arising before 1 september 2018 and yet to be claimed by that date must be reported if it is to be claimed.

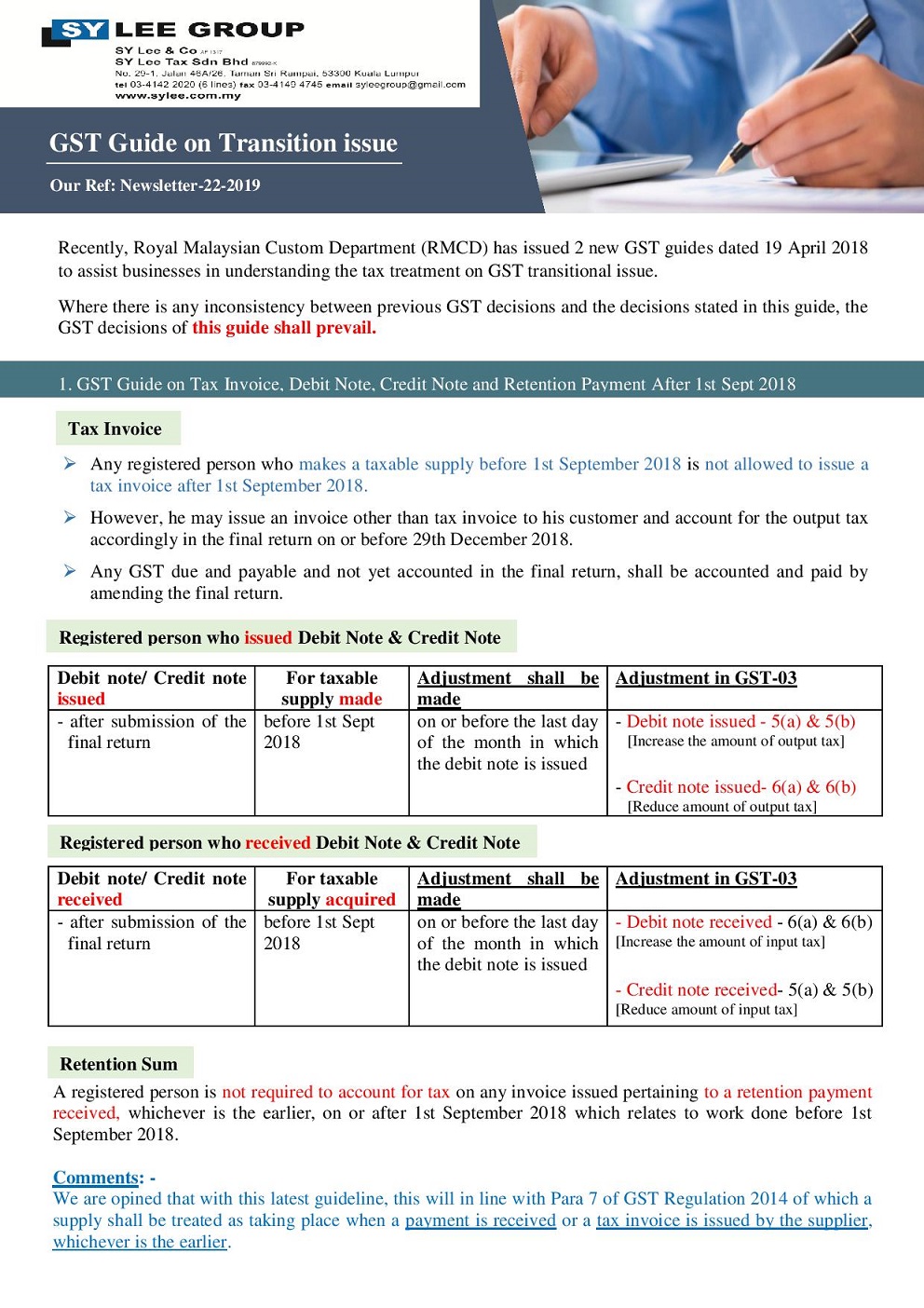

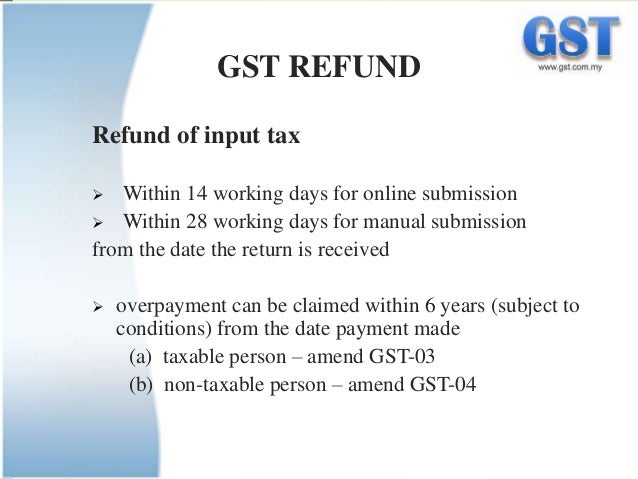

To view sales tax license information and sales tax return schedule. Gst f5 f8 to the comptroller of gst within one month from the end of your accounting period. Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia. A credit note debit note received in the last taxable period adjusting input.

The deadline for submission of the gst f5 form is within one month from the end of an accounting period. The gst was implemented on 1 april 2015 through the gst act 2014 and its various subsidiary legislations. The submission of this final gst return fell on 28 december 2018. Goods and services tax or gst is a broad based consumption tax charged in addition to the price of imported goods as well as a wide ranging category of goods and services in singapore.

Attention please be informed that this portal will remain active until further notice. Gst guide on declaration and adjustment after 1 september 2018 this. 2 at a glance 2 1 as a gst registered business you are required to submit the gst return i e. To submit sales tax return.

Gst submission guide gst 03 return for final taxable period all gst registrants are required to submit the gst 03 return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01 09 2018 to 29 12 2018. Reporting gst returns via gst f5 form to iras. Besides the general guide on gst industry guides are also made available. Online payment a procedure to login return payment.