Eis Contribution Rate Table

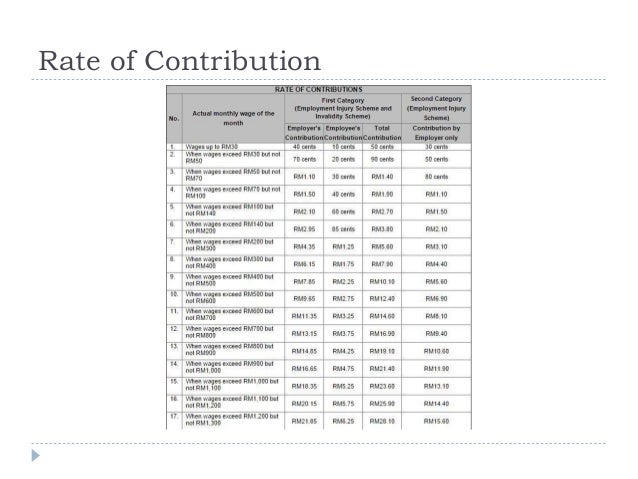

The contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017.

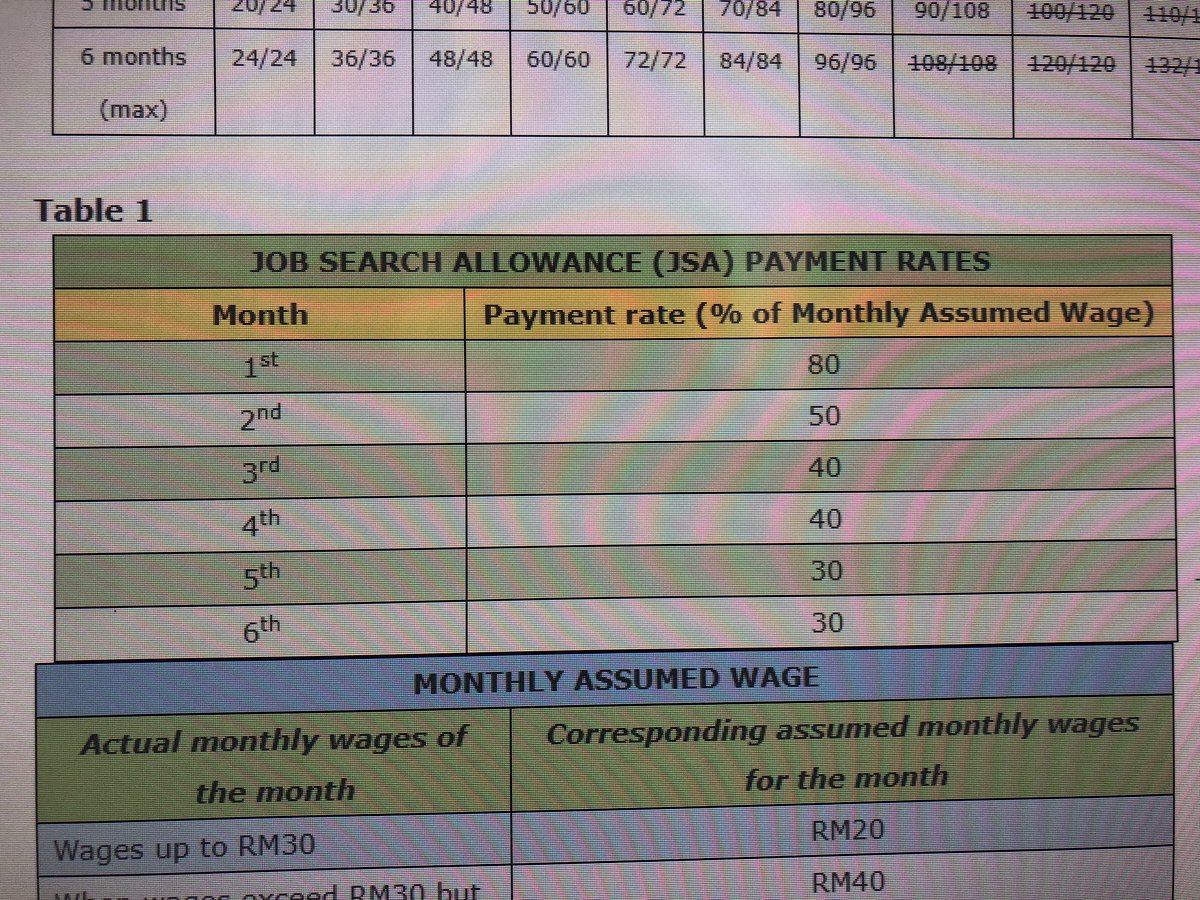

Eis contribution rate table. Both employers and employees are required to contribution 0 2 of their monthly wages. Eis contribution rate the contribution rate for employment insurance system eis is 0 2 for the employer and 0 2 for employee based on the employee s monthly salary. Looking at the table above why is my eis contribution not exactly 0 2 of my wages salary gaji. 03 4256 7798 sms.

Eis contribution rate the contribution rate for employment insurance system eis is 0 2 for the employer and 0 2 for employee based on the employee s monthly salary. The amount paid is calculated at 0 5 of the employee s monthly earnings according to 24 wage classes as in the contribution table rates below along with. Epf contributions tax relief up to rm4 000 this is already taken into consideration by the salary calculator life insurance premiums and takaful relief up to rm3 000. For more other information related to latest eis information can be found at https.

Menara perkeso 281 jalan ampang 50538 kuala lumpur. The contribution rate for eis is 0 2 of the employee s salary employer share and 0 2 of the employee s salary employee share. The contribution rate is based on section 18 and schedule 2 of the employment insurance system act 2017. The table of contribution rate can be refer here.

You may refer to the contribution table below for more information. Menara perkeso 281 jalan ampang 50538 kuala lumpur. Eis will start to implement from 1st january 2018. I c your complaint send to 15888.

03 4256 7798 sms. All employers in the private sector whose employees are covered under. The maximum eligible monthly salary is capped at rm 4 000. Employer are required to manage and submit eis contributions to socso.

I c your complaint send to 15888. Contribution table rates the contributions into the scheme depend on an employee s monthly wage and it is contributed by both the employer and the employee. Jadual pcb 2020 pcb table 2018. Epf contribution third schedule.

The actual contribution amount follows section 18 second schedule of the employment insurance act 2017 not the exact 0 2 percent calculation. Examples of allowable deduction are. Therefore the amount reflected on your payslip will not be exactly 0 2 percent of your salary wages gaji.